The digital marketing landscape is constantly evolving. And with search poised to transform with generative AI, we are often asked by our enterprise clients if continuing to invest in SEO is the right way to go in 2024, especially with overall marketing budgets tightening. The answer is yes. Especially for banking and financial services organizations, optimizing for visibility in Search, or SEO, needs to remain an essential part of performance marketing strategy to ensure you stay top-of- mind for your customers through these times of change.

Here’s a list of eight strategic tactics and best practices we recommend you follow in 2024 to strengthen your banking and financial services SEO program and turn search into a lead-gen channel that impacts your bottom line.

Let’s get started!

JUMP TO KEY SECTIONS – 8 Strategic Best Practices for SEO for Banks

- Take a customer-centric approach to keyword targeting

- Understand and implement the architectural practices for nesting

- Keep a pulse on SERP ranking with partner brands

- Be mindful of Google’s algorithm updates, including Helpful Content

- Allow your users to flow up and down the funnel

- Integrate FAQs to make them relevant to Search

- Harnessing first-party data would be essential

- Optimize for mobile-first indexing and higher page speeds

1. Take a customer-centric approach to keyword targeting

Over the years, there has been talk about whether keywords are dead. At iQuanti, we consider keywords as directional cornerstones for what consumers are actually looking for – the power of keywords is in understanding the intent behind the queries.

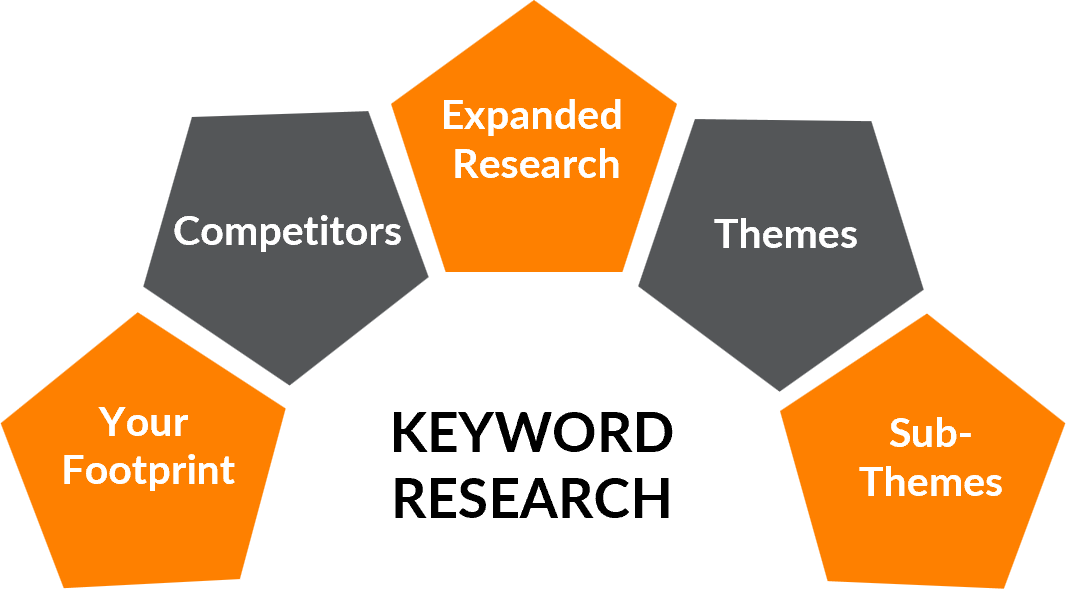

Here is a framework we recommend to bank SEOs:

- Define your keyword landscape.

- Understand your organic footprint and your competitors’.

- Bring these together and cross-reference them to identify gaps.

- Expand your keyword research to isolate new opportunities and then segment your keywords to themes and sub-themes mapped to specific intents.

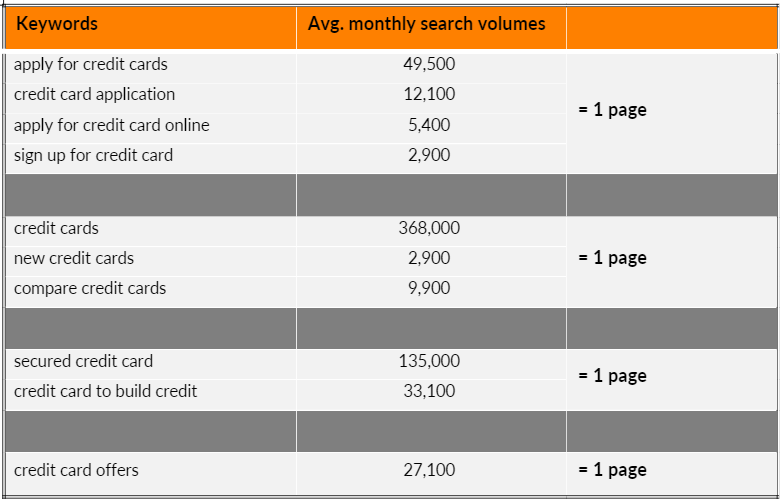

Look at the example below to see how keyword theming can help build a more structured approach to content based on intents.

Here are a couple of pro-tips as you set out to bolster your keyword strength:

- With banks and large financial institutions, we often see a heavy reliance on branded terms to bring in traffic and acquisitions from Search. The issue with a handful of acquisition pages doing the heavy lifting and ranking across the board for hundreds of keywords is that the content tends to get broader and generic and leaves a lot of user queries unanswered. It also means that you are more susceptible to rank loss over time as Google continues to tinker with their algorithm to ensure their users get the best possible answers, every single time.

- SEO for banks and financial services has always struggled with gaining ranks and acquisitions for the “best” keywords (best credit cards, best mortgage rates, for example) because of strict regulations that the industry is subject to. Your legal teams may not approve of “best” themed keywords (like those that aggregators are able to build), but this does not mean you cannot match the intent of the user in other ways. Look for opportunities to build content around what is best for the customer – legal and compliance usually do not have any problems with this approach.

Taking such a customer-centric approach to keyword targeting will ensure you always stay relevant and that you are building content that meets the right intent at the right stage of the user journey.

2. Understand efficient architectural practices for nesting

Allowing Google to find the right data in the right locations is key for an effective site architecture. A structured information architecture and URL taxonomy can provide a significant boost to your SEO value.

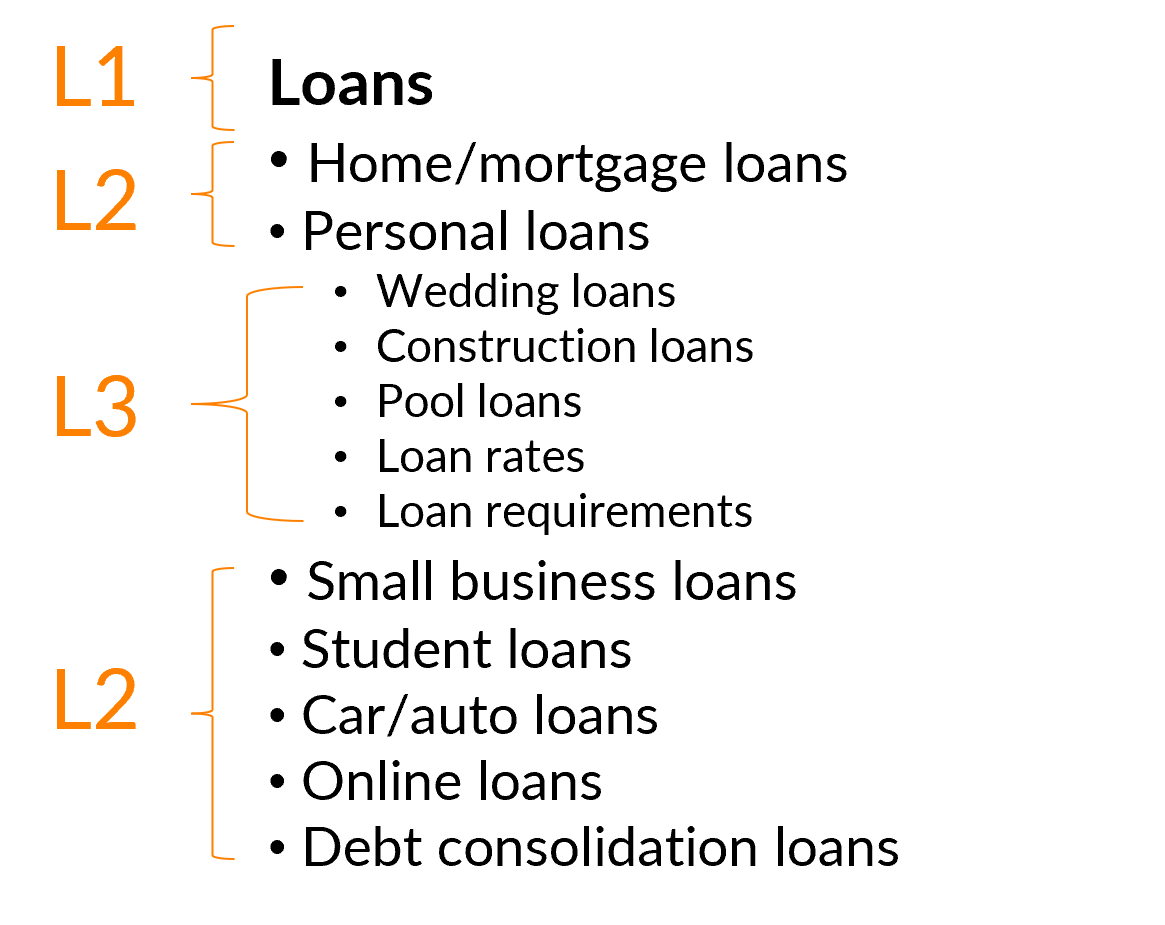

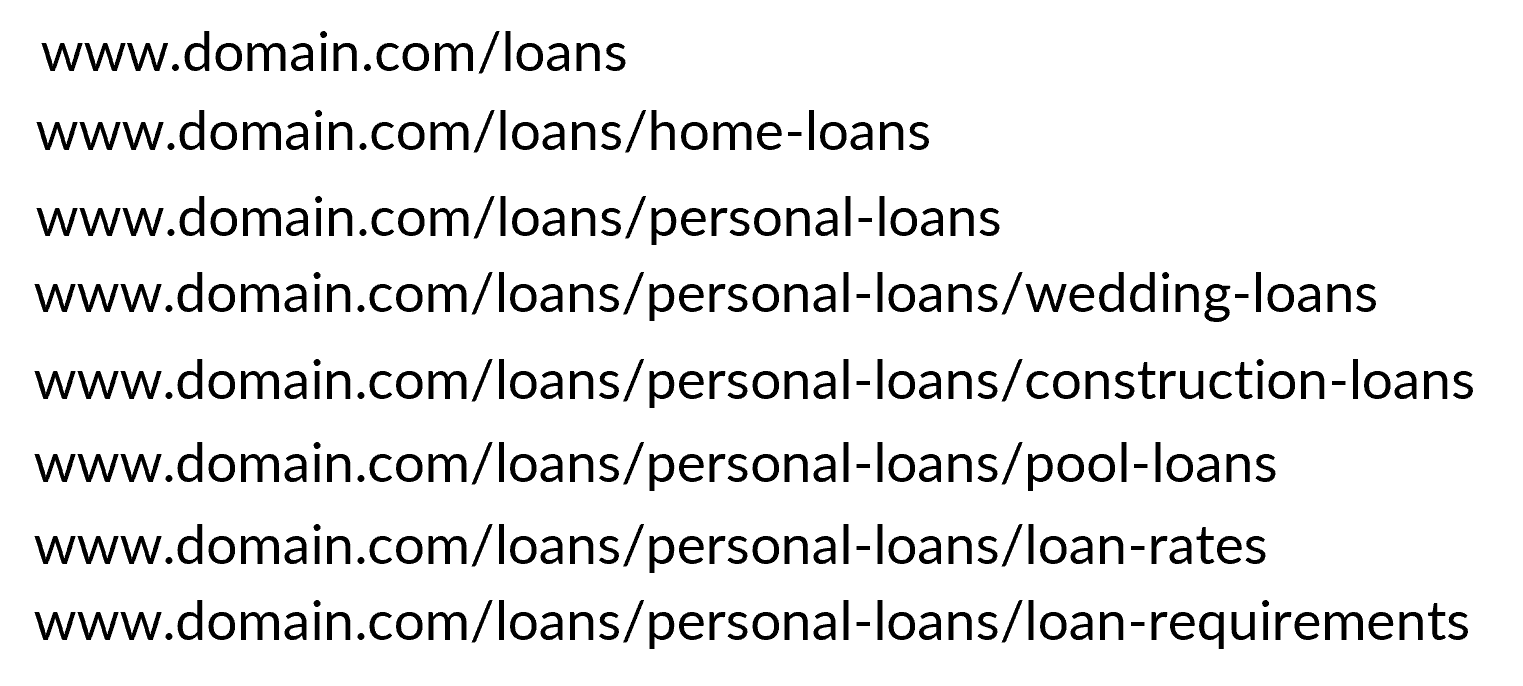

Remember always that you cannot create orphan pages on your enterprise bank website and expect Google to figure it out. Bots are programs – they may eventually find you and index you, but it is more efficient if you give them the right data signals and snippets of information to help them find what they are looking for. Here’s a sample of an ideal architecture and URL taxonomy for a bank which offers loan/mortgage services.

Pro-tip: Be mindful of consumer demand (as expressed via keywords/queries) while building the URL taxonomy and parent-child pages. In the above scenario, for example, we would recommend using home-loans vs. mortgage-loans, even if the product is called that. Why? Because ‘home loans’ have an average monthly search volume of 18,100 whereas ‘mortgage loans’ only have an average search volume of 9,900.

3. Keep a pulse on SERP ranking with partner brands

At iQuanti, we work with several banking and financial services players who work with co-op or partner brands. Retail portfolios, especially, are a popular co-brand category for issuers because they benefit from strong loyalty among shoppers and tend to have high repeat engagement. In such cases, how do you assess your presence in SERPs, specifically, if you are competing against your co- or partner brand?

In most cases, you would notice that your partner brand grabs the first (and sometimes even the top 5 positions). It is key to understand here that the CTR on these SERP pages would depend on the intent of the user. For example, if a user searches for a Citi Best Buy credit card and is looking to apply for the same, they may not visit the product page on Best Buy’s website even if it may be the first (or/and 2nd and 3rd) in the search results. She/he may want to navigate to Citi’s website to do so.

The key takeaway for bank SEOs here is that sometimes the second position is just as strong as the first position based on the user’s behavior. Start looking at your partner and co-brands as a third segment altogether, and not just as stand-alone acquisition pages. Do an extensive keyword research exercise (as highlighted in our first tactic) and create separate pages for the partner brands and more mid- and upper-funnel pages that match the intent of user queries to help the user complete the journey from information to purchase smoothly.

4. Be mindful of Google’s algorithm updates, including Helpful Content

Google’s algorithm continues to evolve. In August 2022, Google’s Helpful Content update had rolled out that specifically targeted “content that seems to have been primarily created for ranking well in search engines rather than to help or inform people.”

The update prioritizes content that is useful, relevant, and easy to understand for users. This means that Google is making changes to ensure that content that is well-written and provides value for the reader will be rewarded with higher rankings on the SERP. Now, the criteria for helpful content depends on the context, but generally, it should be accurate, comprehensive, up-to-date, easy to understand and actionable.

Content written only for SEO rarely works. Optimizing for Search is about filling a gap in the users’ information journey. What does this mean for SEO for banks? With the Helpful Content update, you need to focus on creating content that is useful to your customer journey and present it in an engaging, organized and visually appealing way. Explore more content formats like videos that meet your customers where they are.

5. Allow your users to flow up and down the funnel

In a 2020 study, Google’s consumer insights team found that “how people decide what to buy lies in the ‘messy middle’ of the purchase journey.” What happens between trigger and purchase decision-making is not linear, and with the growth of the internet, it has only gotten messier. The study highlights that the “messy middle” equates to two mental modes – exploration, an expansive activity, and evaluation, a reductive activity.

What does this mean for financial services SEO marketers? Focusing on acquisition pages and converting branded keywords alone is not enough anymore. You need to look at different KPIs for different levels. For your down-funnel terms, conversions could be a valid KPI, whereas your up-funnel pages can focus on brand awareness and aim to get people into the conversion funnel. With stiff competition from aggregators, banks and financial services brands need to focus on building topical relevancy through content to rank consistently and to ensure they are able to make a full-funnel connection with users.

6. Integrate FAQs to make them more relevant to Search

The days of one long FAQ page that tackles multiple questions and a multitude of intents is a thing of the past. Bank SEOs need to make their FAQs more relevant to search by breaking up FAQ content and moving them to the appropriate pages. This will allow you to answer user queries where they are most relevant, without breaking their journey.

For example, a query like “How do I stop automatic payments on my Amex Blue Cash Card?” should be housed under the specific product page, whereas a query like “What is considered a fair credit score?” can be housed on supporting pages or article pages that talk about credit scores.

The screenshot below shows how American Express does this efficiently on their No Annual Fee Credit Cards page. The most commonly asked questions are integrated into the category page itself, which reduces the chances that a user will navigate out of the website to start a new Google query again.

7. Harnessing first-party data would be essential

With third-party cookies going away from Chrome before 2024 and increased focus on privacy regulations across the globe, it’s essential for financial marketers to focus on harnessing the full potential of their first-party data. As you build your MarTech stack to make this happen, your SEO program can contribute significantly to this effort as well. Your upper and mid-funnel content can help garner valuable information about your customers.

8. Optimize for mobile-first indexing and higher page speeds

A lot of banking and financial services players, both big and small, took a hit with Google’s Core Web Vitals update. It came as a surprise to many since page speed is not an established Google ranking factor. But here is the kicker that many bank SEOs seem to have missed – page speed is a page experience factor and page experience is a ranking factor. So indirectly page speed is a ranking factor!

Pro-tip: Given that the best practice today is to have your page load up within 2-3 seconds (with mobile-first indexing being the priority), it is critical to look at how your page loads. Oftentimes, there may not be significant loading issues with specific core elements of a page, but if there is a disconnect between the SEO and development teams, simple code placement errors can lead to longer load times and subsequent loss of rankings and traffic.

Let’s look at an example. Let’s say your website has a third-party attribute that makes an API call every time your page loads (and most bank websites have multiple such attributes on their web pages for tracking and third-party integrations etc.). If your SEO/analytics teams hands over this code to your development team without any specific directive on placement and if the code gets placed in the header tag by chance, then every time your page starts loading, the API will run first and the milliseconds taken to connect to its server will add to your page loading time. At the face of it, none of the teams – SEO, analytics or dev – may spot an issue, but you’ll struggle to bring down your load speed, even after you optimize every other element on the page.

If multiple pages on your website are template-based, it will be easier to optimize these templates and ensure your efforts can make an impact at speed and scale.

The Final Word

Building impactful SEO programs for banks and financial services needs a deep understanding of the undercurrents and regulations specific to this vertical. But with the right strategy in place, and with these tactics in your toolbox for 2023, SEO marketers can absolutely turn Search into an effective lead-gen channel that bolsters your bottom line.

If you have any questions or comments or need help assessing your existing SEO program/strategy, please feel free to reach out to our banking & financial services performance marketing experts today. Email us at marketing@iquanti.com.