The digitization of financial services has seen tremendous acceleration since the pandemic, sparking a global fintech revolution that has disrupted the traditional banking industry. Neobanks – digital-only fintech companies that offer mobile and online banking products and services – are a key part of this change. As these banks emerge as challengers to traditional banks, here’s what you need to know about the current neobanking landscape and what it means for financial marketers.

What are Neobanks?

Neobanks are financial institutions that offer banking services primarily through online and mobile channels, without any physical presence. Over the last few years, there has been an explosion in the number of neobanks across the globe. They leverage digital technology to offer innovative financial products and services and have no brick-and-mortar or branch locations.

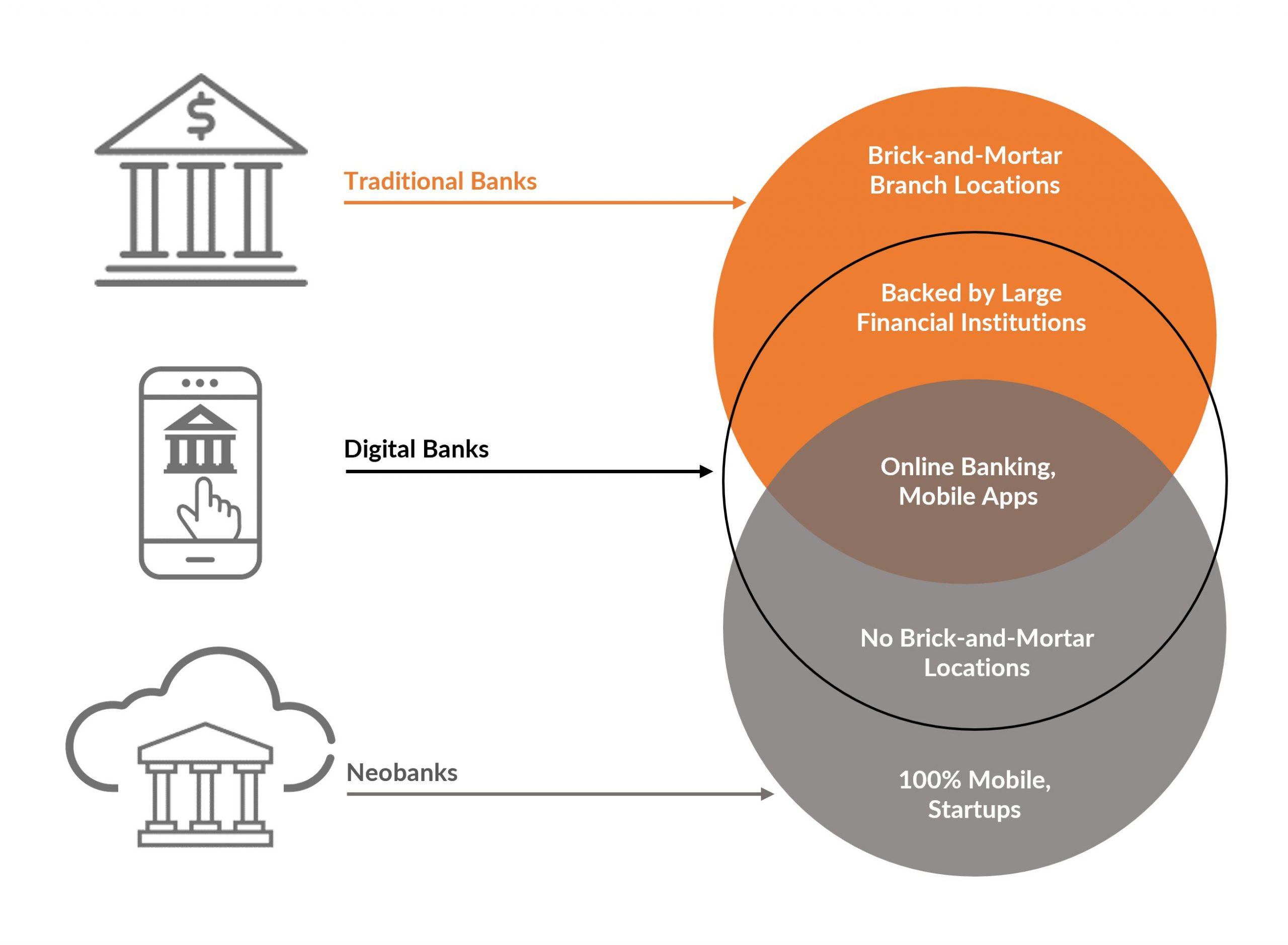

Neobanking and digital banking are often used interchangeably, but despite the heavy reliance on smartphones and other digital devices, they follow two distinct business models. Here is a quick infographic to help understand the major differences between traditional banks, neobanks and digital banks.

Figure 1: A comparison of traditional banks, digital banks, and neobanks (Image recreated from Nielsen)

Neobanks have gained popularity among consumers due to their convenience, flexibility, and lower fees compared to traditional banks. They offer seamless onboarding processes, intuitive mobile apps, and real-time access to financial information, making banking easier and more accessible than ever before.

Recent research shows that the neobanking market is estimated to have generated over $2400B worth of transactions in 2022 globally and is anticipated to grow at a CAGR of over 25% from 2023 to 2028. The number of neobank users worldwide is projected to reach 394 million in 2023, up from 39 million in 2018, according to a recent Statista report.

What are the different types of neobanks?

Depending on the type of activity and services/products they offer, neobanks can fall under three operating models:

- Pure play neobanks that have full or restricted virtual banking licenses that regulate them and offer core banking and other value-added services.

- Incumbent digital subsidiaries which are digital-only direct offerings of traditional banks to counter emerging virtual banks and tap into digital adoption.

- Neo-banks that do not have virtual -banking or e-money licenses and operate in partnership with traditional banks in the country.

Which are the top neobanks in the US?

Based on Insider Intelligence forecasts for 2023, here are the top neobanks or digital-only banks in the US, by market account holders:

- Chime (21.6 million)

- Varo (5.4 million)

- Current (4.6 million)

- Aspiration (4.5 million)

What advantages do neobanks offer vs. traditional banks?

By leveraging technology and AI, neobanks have been successful in bridging the gap between the services that traditional banks offer and the changing customer expectations in the digital age.

Let’s look at three core reasons why neobanks have grown:

Focus on convenience & economics

Neobanks follow a ‘mobile-first’ model and use latest technologies to deliver innovative and convenient services and products to customers that are often more attractive than those offered by traditional banks, for example, personal finance advisory, e-bill generation, free debit cards etc. By minimizing operational costs, they are able to offer more competitive rates and fees than brick-and-mortar banks.

Focus on user experience & personalization

Neobanks often appeal to tech-savvy customers via personalized and innovative financial products, such as user-friendly mobile apps, budgeting tools etc. Most of them offer an “à la carte finance” model. Additionally, they are able to provide round-the-clock customer support through chatbots and other automated tools.

Focus on rewards & cashbacks

Neobanks build customer loyalty and stimulate engagements by offering high interest rates, customized cashbacks, rewards, and deep discounts through e-commerce partnerships etc.

Challenges and opportunities for neobanks

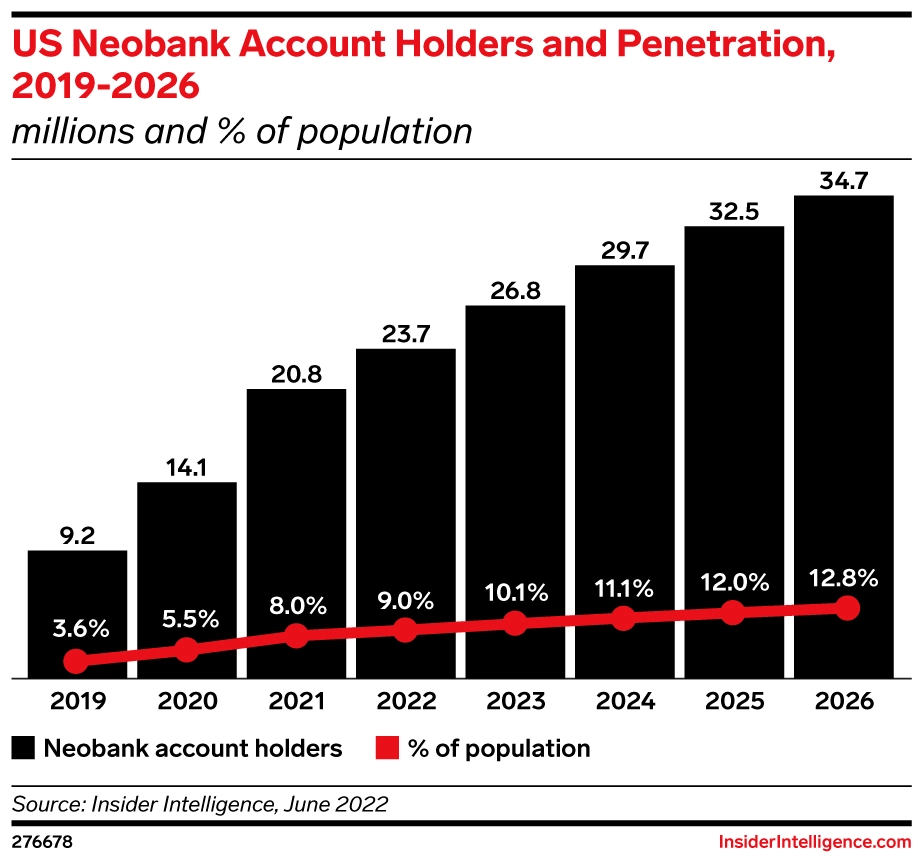

Neobanks have emerged as a significant threat to traditional banks in the US. But even as they continue to grow in popularity and influence, neobanks also face significant challenges. In fact, According to research from Insider Intelligence, neobanks are expected to see low growth ahead – the CAGR of new account openings from 2022 to 2026 will be under 1%.

Figure 2: Neobank account holders and penetration between 2019-2016 in the US (Image courtesy Insider Intelligence)

Their challenges include:

- Building customer trust: A 2021 survey by Accenture found that 49% of US consumers trust traditional banks to safeguard their personal information, compared to 41% for neobanks. However, neobanks scored higher than traditional banks on measures of transparency, convenience, and customer service.

- Regulatory compliance: Regulatory requirements in the US are stringent, and neobanks are required to comply with a slew of federal and state regulations. This drives them to rely on partnerships with traditional banks for regulatory compliance and access to financial infrastructure, which can limit their autonomy and increase their costs.

- Establishing a sustainable business model: New research shows that neobanks are actually “struggling to turn a profit, with only a mere 5% of the world’s reported 400 digital banks reaching breakeven.”

- Increasing competition: There are over 290 neobanks operating globally at the end of 2022. The market has become increasingly competitive, and neobanks will invariably need to shift their attention to profitability in 2023. With traditional banks and fintech companies launching their own digital banking platforms, neobanks will need to pivot quickly to stay ahead of the competition. As the failure of Google Plex and Uber Money shows us, only those who are able to find a niche (or underserved) market and are able to deliver a truly differentiated value proposition to their target customers will thrive.

- Ongoing economic uncertainty: Neobanks often have customers with small average deposit balances and if the economy takes a turn for the worse this year, any surge in unemployment or layoffs could directly impact the deposit flows for neobanks. Also, with venture capital flow and marketing budgets drying up, neobanks may struggle to keep delivering on the lavish incentives, low to no fees, and innovative products that give them a competitive advantage.

But it’s not all bad news. With ongoing economic uncertainty, the focus of larger banks and financial services organizations will be on improving revenues and saving costs rather than technology upgrades. Consequently, we expect to see a rise in the number of mergers and acquisitions as traditional banks invest in absorbing the technology, innovative products, and digital capabilities of neobanks. JP Morgan’s acquisition of Renovite in late 2022 is an example.

The neobanks that survive will be the ones that retool their strategy and rely on more than just perks to remain competitive. This may mean revamping their underwriting policies to bring in customers who will drive higher balances and tapping into new revenue streams like BaaS, credit cards and lending products, and subscription fees. Neobanks like Starling, Nubank, and Revolut have already made exciting progress in each of these areas.

Beating Neobanks at Their Own Game: A 3-Point Strategy for Bank Marketers

After being challenged for over a decade, can traditional banks finally beat neobanks at their own game? What are the unique opportunities that the current economic uncertainty presents to established banks? Our experts share a bank marketing strategy for financial marketers to expand their market share and build new digital capabilities, all in one go.

1. Offer trust as a core value proposition

Across regions, we have seen that while traditional banks still enjoy the benefits of being a customer’s primary financial institution (PFI), the trend is evolving, with Gen Z consumers open to maintaining multiple banking relationships.

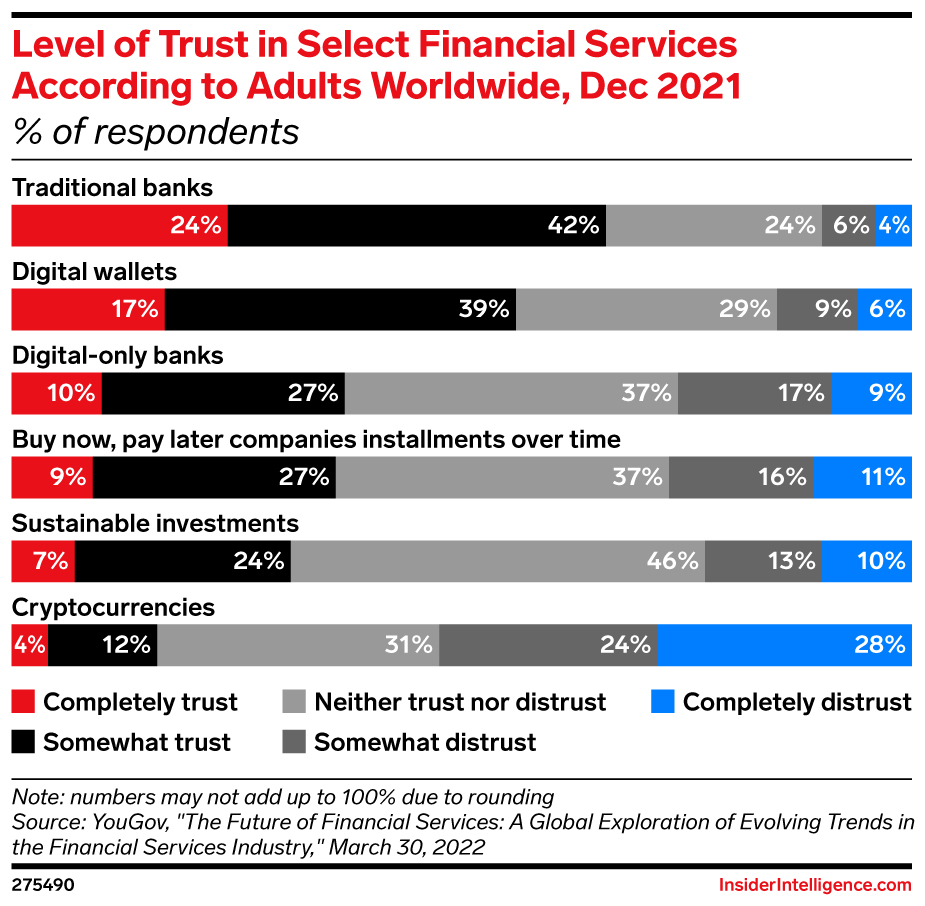

However, consumers still trust traditional banks more than neobanks.

Figure 3: Level of trust in select financial services worldwide in Dec 2021 (Image courtesy Insider Intelligence)

Nonetheless, it is critical for financial marketers to understand that they need a renewed definition of ‘trust’ in the digital age.

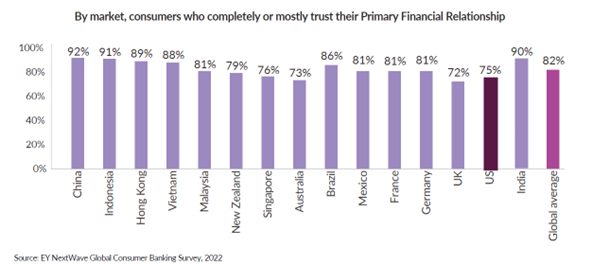

EY’s Next Wave Global Consumer Banking Survey 2022 revealed that most consumers completely trust their Primary Financial Relationships (PFRs), ranging from 72% of UK consumers to 75% of American consumers.

Figure 4: Consumers who completely or mostly trust their PFR, by market (Image courtesy EY)

However, the survey also identified that today’s consumer’s trust in a banking institution is not limited to how safely and accurately they handle their money (especially larger transactions) or how resilient they are as an organization. It is also reliant upon “how financial players empower their customers to make decisions about using customer data to personalize experience and create more value through customized products and services.”

And herein lies the opportunity for banks. They need to invest heavily in enhancing their data security and privacy protection and put customers in control of non-financial data like geo-location that banks have access to. Banks that take a proactive approach to empowering customers will emerge as trust-winners.

2. Boost digital prowess and reach through strategic acquisitions and partnerships

With investors’ focus shifting to profitability and equity funds drying up, many neobanks are struggling to exist. For smaller or regional banks, this presents a unique opportunity to increase their digital capabilities and customer reach through acquisitions vs. building from scratch. Larger banks that already have established digital teams could also benefit from the right fintech partnerships to build products and services faster.

3. Constantly pivot to stay competitive

Banks should expect to see increased competition in mainstream BFSI categories. Marketers need to look out for neobanks that might also venture into new revenue streams like credit cards, lending etc., posing direct competition. With neobanks struggling to retain the aggressive discounts and benefits they initially had for on offer for their customers, banks will now see a more level playing field. It would make sense to revisit their communication strategy, since the messaging which wasn’t effective in the past owing to more aggressive offers from neobanks, could work now.

By focusing on their current strengths – trust and human-based customer service – and ramping up privacy, personalization, and product innovation, banks and credit unions can compete better and draw consumers back into the fold.

Read the Q2 2023 edition of our quarterly report for financial marketers for more insights on neobanks and other trends that matter.

To understand if you are poised to compete and thrive in 2023 and beyond, reach out to our Digital Solutions experts.