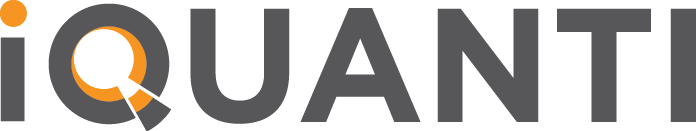

Financial services digital ad spending expected to surge in the next few years

Digital ad spending in banking, financial services, and insurance sectors experienced a sharp decline in 2022 and 2023 amid prevailing bearish sentiments in the economy.

Financial marketers have realized they may have overcorrected on recession fears, and seem ready to open their wallets again. The sector is poised to cross $33 billion in digital ad spending in 2024, and only the third industry to surpass this milestone. This is reflective on search ad spending as well which is expected to see a recovery with over 12.4% growth in spending this year.

Banking and Insurance digital ad spending expected to rebound in 2024

Amid economic uncertainty, expense pressures, and a dip in loan demand across key categories, banks had pulled back on ad spending in 2023. However, spending is now set to increase as banks adapt to digital media trends and major players take advantage of the industry's pullback. consumers’ media consumption patterns are pushing ad dollars to digital. And resource-rich banks are disproportionately increasing spend.

Top ad spenders among the US P&C insurers, including Geico, Allstate, Progressive, and State Farm had slashed advertising expenses last year. As inflation and supply chain bottlenecks ease, the spending is expected to bounce back in 2024.

Social dominates push media spends for the financial services in 2023

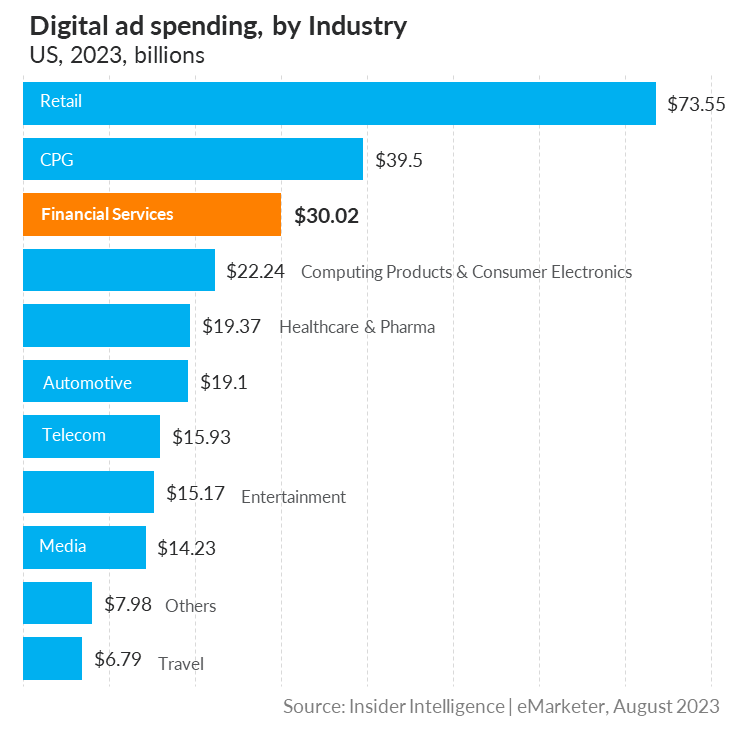

According to recent research on US Digital Habits by Generation (eMarketer), Millennials and Gen Z are setting the path for digital adulthood. While digital habits like social media and streaming are cross-generational, adulthood is propelling Gen Z and millennials toward digital solutions for responsibilities like banking and healthcare.

At the start of 2024, Millennials make up more than half of all digital-only banking users, nearly twice the share of Gen Xers.

They also make up the largest share of users on 9 out of the 11 major digital platforms, including Instagram, Reddit, YouTube, and Whatsapp. Snapchat and Tiktok are the go-to digital platforms for younger consumers and Gen Z is expected to take the lead on Disney+, YouTube, Instagram, and X (formerly Twitter) by the end of 2024.

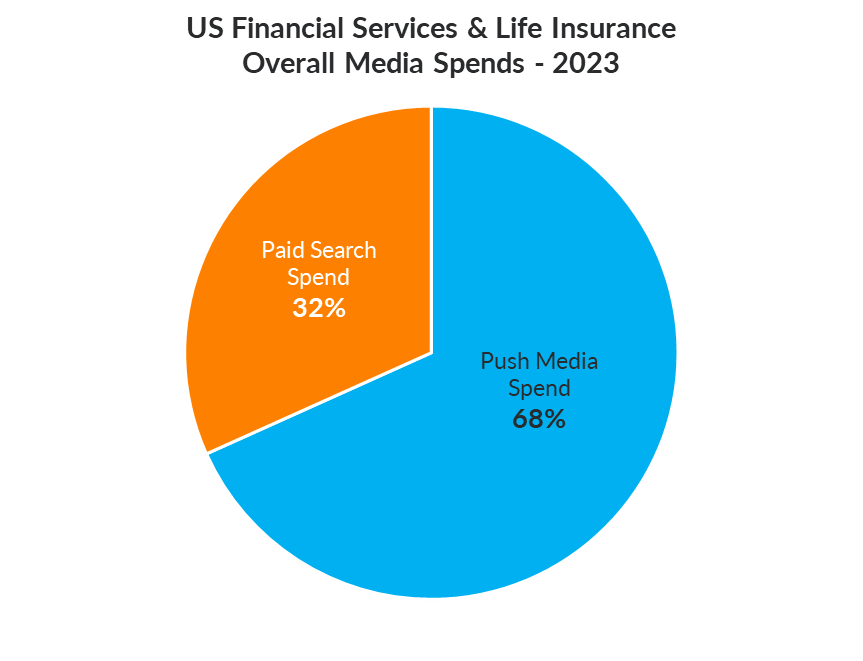

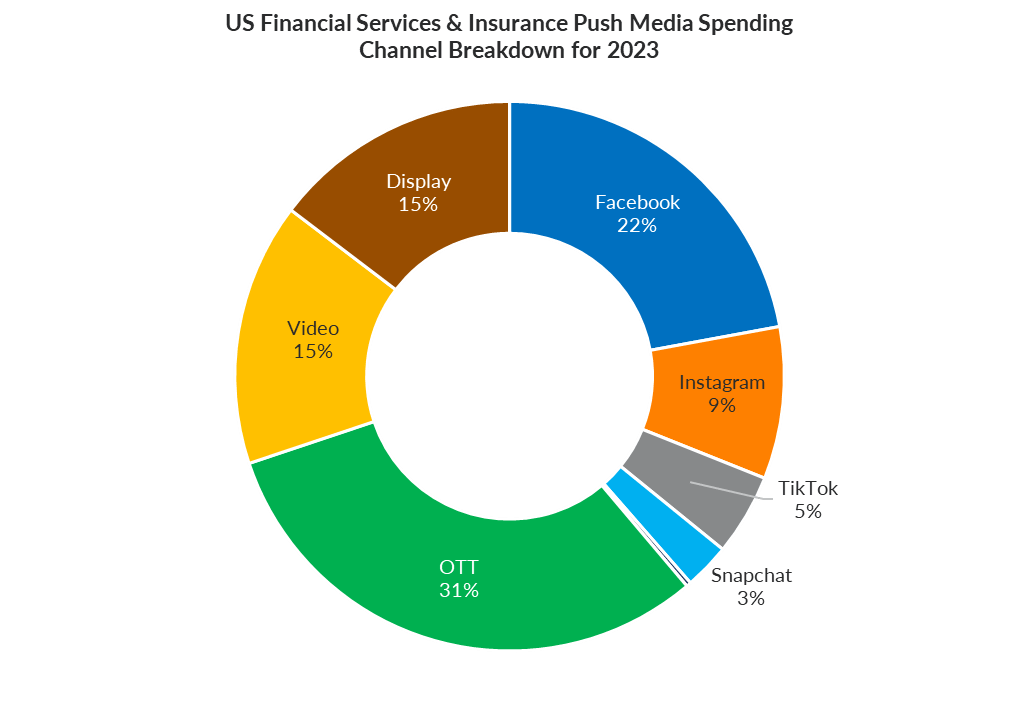

Of the overall US financial services and insurance media spending in 2023, paid search and push media accounted for 32% and 68% respectively.

Social continues to be the leading channel for financial services. Even though social’s YoY share within the channel breakdown has gone down, it still commands 39% share of the digital ad spending.

TikTok and Snapchat’s share in the channel breakdown has gone up. Twitter, because of the current ongoing issues with the platform, has seen negligible spends in most of the categories.

Banking and finance advertisers shift focus to Video content

Advertisers across all major banking and financial services categories are increasingly investing in video channels and content. Approximately two-thirds of total push media spending in 2023 was allocated to video platforms, including OTT, Facebook, Instagram, and TikTok.

With the rise of Gen Z as a potentially strong target audience for banking and financial services in 2024, this trend gains even more relevance.

Globally, subscription-based over-the-top (OTT) platforms have gained immense popularity, with an estimated 44.9% of internet users worldwide expected to engage with them in 2024. Leading the market are streaming giants like Netflix and Amazon Prime.

Top OTT players in the US market, including Peacock, Paramount+, Hulu, Disney+, Netflix, and Max enjoy high penetration of ad supported viewership.

Year-over-year, the share of video and OTT spending has risen across various BFSI segments, including credit cards, personal loans, student loans, and life insurance. In 2023, OTT captured a 31% share of all digital ad spending, marking considerable growth from 2022.

| Video | OTT | |||

|---|---|---|---|---|

| Category | Channel Share 2022 | Channel Share 2023 | Channel Share 2022 | Channel Share 2023 |

| Credit Card | 20% | 26% | 29% | 33% |

| Personal Loan | 5% | 12% | 12% | 42% |

| Student Loan | 9% | 18% | 9% | 26% |

| Mortgage | 11% | 17% | ||

| Life Insurance | 6% | 10% | 25% | 36% |

In-depth digital media insights

Read our detailed analysis and insights specific to different Banking & Financial Services sub-categories here.