Alphabet’s Q2 2019 results demonstrate Google’s continued relevance to both consumers and marketers. While the year-over-year growth in revenues and profits show strength in Google’s core search and display business, it is also interesting as a marketer to understand how that growth is powered by a continued commitment to AI, more diversity in performance ad formats and a trend towards diminished costs for performance marketers.

Here is a marketer’s analysis of

- What has powered Google’s trend of revenue growth Y-O-Y and

- The implications of this growth from a performance advertising perspective.

Revenue and profit growth in Q2 2019 led by Google’s search and cloud businesses

Alphabet, Inc. (GOOG) beat Wall Street expectations in the second quarter, pulling in $38.9 billion in revenue and $9.2 billion in net income.

Strong results in certain Alphabet business lines—search advertising on mobile, advertising on YouTube and business-to-business cloud services—led to 19% year-on-year revenue growth for the technology giant. Revenues from Google owned-and-operated properties contributed $27.3 billion (18% year-over-year growth) while networks contributed $5.3 billion (9% year-on-year growth), with lesser dependency on Network revenue.

“From improvements in core information products such as Search, Maps, and the Google Assistant, to new breakthroughs in AI and our growing Cloud and Hardware offerings, I’m incredibly excited by the momentum across Google’s businesses and the innovation that is fueling our growth,” Google CEO Sundar Pichai said in a statement accompanying the earnings release.

Alphabet’s revenue and profit ticked up from Q1 2019, in which the company reported $36.33 billion in revenue and a $6.6 billion in net income.

Key Alphabet trends in Q2 2019: What marketers need to know

More AI, a push for privacy and new ad formats

Google’s earnings report proves that the company’s core businesses continue to attract both users and performance marketing dollars. What trends do we see evolving in Google’s Q2 results that may affect performance marketing in the future?

1. AI and AR integrations offer potential for better performance in Search

Google continues to make improvements to its core search product. Across both mobile and desktop, Google is aiming to bring more artificial intelligence-powered features to search—and even integrate augmented reality (AR) into what search users see.

Google CEO Pichai used online shopping to illustrate AR’s potential. “So if, say, you’re searching for new shoes online, you can view the shoes in 3D or even superimpose them onto your wardrobe to see if they match,” he said.

As far as AI goes, Google sees machine learning as a key efficiency driver for performance marketers. AI has a role to play across the customer journey, offering the opportunity to:

- Streamline campaign creation (via automation)

- Suggest the right creative assets to marketers

- Enhance real-time bidding

- Offer real-time performance insights

POTENTIAL IMPACT: We see automation in bidding and creative deployment being two compelling use cases for AI in search. Performance marketers are likely to benefit from the greater efficiency that AI will drive in these areas, but should closely monitor search performance in their vertical or business unit to be sure they are staying competitive.

2. Search Monetization

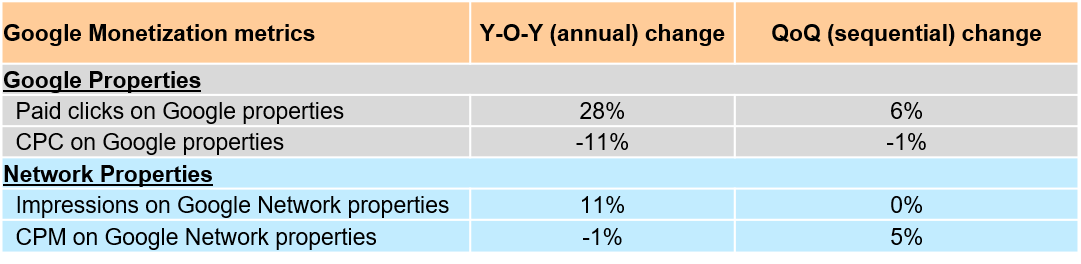

Google’s revenue growth was driven by growth in volume: both in paid clicks on Google properties (+28%) and impressions on Google’s display network (+11%).

At the same time, the value of each click/impression is decelerating: with cost-per-click (CPC) on Google properties down by 11% year-over-year and cost-per-thousand-impressions (CPM) on the display network down by 1% year-over-year.

Some key trends in search monetization metrics are highlighted below:

POTENTIAL IMPACT: The combination of higher search volumes and lower CPCs represent an opportunity for performance marketers to strive for greater reach within paid search. At the same time, falling CPCs and CPMs promise lower overall cost-per-acquisition (CPA).

3. Privacy remains a key consideration

Google continues to improve privacy by giving users more control of their data. The company is investing in the user experience in other ways, too, such as removing bad content at scale.

“More than 8 million videos that violated [Alphabet’s] Community Guidelines” were flagged with the help of AI tools, the company reported. Google dubbed content moderation “one of the most important areas we are working on.”

POTENTIAL IMPACT: An increased focus on privacy is an emergent trend across the consumer tech industry. Google, like other tech giants, is waking up to the fact that consumers care about how their data is being used. At the same time, the company is investing in reducing fraud and improving inventory quality: top of mind considerations for many performance marketers.

4.YouTube continues to surge in popularity

Traffic on YouTube continues to increase, driven by:

- Online video becoming a popular tool for learning; and

- Large channels (those with +1M subscribers) growing 75% year-over-year

Google continues to push its YouTube subscription services, as well. YouTube Music and YouTube Premium are now available in over 60 countries, demonstrating how serious Google is about making YouTube a destination for quality content.

POTENTIAL IMPACT: From a performance marketing perspective, the growth in direct response in YouTube offers an opportunity to gain incremental reach at a lower cost of acquisition. Increased content quality is also a welcome trend.

5. New ad formats show promise

Google introduced new ad formats in Q2 2019, all of which aim to provide a better user experience:

- Discovery Ads: “visually rich, mobile-first ad experience across Google properties”.

- Unified Shopping Experience: an effort to make Google a destination for shopping.

- Google Travel: “a destination to plan and organize travel in one place—from booking flights and accommodations to planning activities.”

POTENTIAL IMPACT: While emergent in nature, all three formats could gain traction quickly. They may offer significant potential for performance marketers as we approach the holiday season.

The Final Word

Overall, Google’s growth is being powered by its core business of attracting marketing dollars. Q2’s growth in search revenue was driven by an increase in clicks, implying users still see Google as a tool for finding information across all aspects of their journey (through mobile, Maps, Assistant and YouTube).

With declines in CPC and CPM and new ad formats, there is significant opportunity for marketers to still use various Google products towards their performance objectives.

How can you ready your enterprise search strategy keeping in step with these trends? Have questions about how to leverage Google’s products or need or feedback on your paid search and SEO implementations?